You might not know one of the best COD countries is Thailand. And people in South East Asia (SEA) like using Cash on Delivery to make sure the purchase is secure. It looks like Cash on delivery is a very back transaction model in eCommerce. How can it possible to become popular again?

I had been sacrificed in Chinese eCommerce for many years. I experienced with selling online and purchase online since I am 20 years ( it is 12 years ago) .

The first time I purchased online is from Taobao and i was ordering a T-shirt, and I am just concerning if I did not receive the order or they just give us the wrong product. Then I just select the Cash on Delivery. When I received the product, it was good. And then I paid for it by Cash.

With the Alibaba growing, and the Alipay become the most popular finance tool and also Taobao is getting more and more reliable to buyers. Buyers never worried about being scammed, so they do not need to use Cash on Delivery.

If they are not happy with the order, then they can dispute it. And 80% of the dispute will be a success to buyers. And also the Purchase on Line is so popular that people trust it even more than offline.

1. More Thais are Spending on Luxuries

To better understand the Thai e-commerce market, it is integral to understand what our Thai shoppers are like.

hailand has a rising middle class that is more willing to spend these days. 61% of high-income households (earning more than THB50,000 monthly) choose to dine out regularly. When they do, they spend three times more than lower-middle-income groups.

Thailand’s increased spending on luxury and experiences is an often-seen trend in developing nations with increasing incomes. Less conservative in their consumption than their neighbors, Thais are more willing to borrow more to fuel their purchases.

BCG interviewed some Thai consumers on their rising debt levels and found that they believe that indulging in luxuries is a reward for their busy lifestyles.

If you are able to supply Thai consumers with the quality they are looking for, opportunities abound whether you are offering consumer products, luxury goods, or experiences.

2. Thais are Brand-loyal, as Long as It’s Not Too Pricey

Thai consumers are the most brand-loyal among Southeast Asian consumers. However, convenience, quality & price are still major factors in Thai purchasing decisions.

More than a third of respondents in a McKinsey survey chose to stick with their preferred brands but would look for places that sold them at a cheaper price.

However, 13% of survey respondents were willing to trade to more affordable brands. Among this group, 62% of them did not revert to purchasing their favorite luxury brands.

When pricing your goods, it’s better to do some field research and find out how much your competitors are pricing their goods in Thailand.

You may be able to break into Thailand if your goods are slightly cheaper than your competitors, while still retaining high enough quality that you gain loyalty from Thai consumers.

3. Thais are Well-connected and Well-informed

A major part of any successful e-commerce strategy is to find out how your target audience gathers information and makes decisions.

E-commerce and social commerce are some of the major trends in the country. This is driven by high mobile penetration rates (95%) & heavy social media usage (4.2 hours a day, the highest among SEA countries) .

Thais want to stay well-informed before making purchase decisions, with 40% of customers depending on reviews and recommendations online.

Most of the time, this is done on platforms like Facebook and LINE. This means that word-of-mouth and positive reviews are critical when it comes to e-commerce Thailand, similar to other established e-commerce markets.

4. More Thai Women are Purchasing Decision Makers in their Households

Thai women, in particular, are an e-commerce market segment worth noting. Thai women are well-educated, with those aged 15 or older having one of the highest employment rates (64%) in any global economy including North America and Western Europe.

With higher purchasing power, Thai women often take on the role of primary decision-makers in the household, even for traditionally male purchases such as alcohol & durables.

Thai women are shrewd too – 27% of them research products online before making purchasing decisions, and 29% of them follow through with purchases online.

In comparison to the 21% research rate and 18% follow-through rates borne by men, providing more information on product quality and pricing could help you convert more sales when it comes to female shoppers.

START & SCALE YOUR DROPSHIPPING BUSINESS FROM HERE

Reaching Thai Consumers

Thai shoppers can be hyperaware, price-conscious and socially sensitive. What we can do is build your brand’s strength and gain loyalty by building trust and being transparent with the costs and details of your products and website.

For instance, when setting up your e-commerce page, maintain & organize your prices, products and delivery information in a transparent and easy-to-understand way.

Building Trust

Trust is a big factor for Thai e-commerce consumers. The fear of fraud in online shopping deals was cited as one of the major concerns that Thai consumers have when it comes to e-commerce.

Overcoming this barrier brings you one step closer to closing sales with Thai online shoppers.

In order to build trust, Thais prefer a more personal touch when it comes to online purchases, preferring to interact directly with sellers on platforms like Facebook or Instagram before making a purchase.

For instance, La Mignonne, a popular Thai online clothes store on Facebook, has a customer service team that responds to customer queries or feedback via Facebook comments and has 1.5 million followers there.

It is also vital to note that they would prefer dealing with other Thais and are comfortable with people who speak their language. If you are planning on selling to Thailand, it’ll be a good idea to have a local team in place to engage shoppers and provide customer service.

To provide more price transparency, shopping search engines & shopping comparison sites aim to streamline the market by aggregating price & search results.

These companies, like Priceza &iPrice, drive customers to the best sites based on their motivations, such as brands or pricing.

Cash on Delivery

In order for the e-commerce sector in Thailand to succeed, it has had to adapt to the needs of its customers. In Thailand, like in many other countries in Southeast Asia, Cash/Collection on Delivery (COD) is offered to tackle the resistance to digital payment and boost e-commerce transactions.

COD enables shoppers to pay the delivery person with cash upon receiving the goods. Popular e-commerce websites such as Lazada and Pomelo offer Cash on Delivery as a form of payment but many companies still do not as COD comes with its own challenges.

It often involves financial and logistical risks, such as rerouting drivers so they aren’t carrying large amounts of cash and ensuring both the item and the money is collected. Cash also takes longer to process and leaves the seller with money in pocket at a later time than a credit card transaction would.

The seller is also more vulnerable to losses because COD makes it easier for the customer to return the product at the time of delivery. For example, a consumer may have placed an order for two dresses and selected COD as the payment method. However, she may change her mind upon seeing the merchandise and use her right to refuse payment for one of the items.

The delivery is a greater charge incurred by the seller because the customer decided to buy only one item, even though she ordered two. Offering COD also requires merchants to have high capital on hand as they must pay for the delivery of the package to the customer without being paid first.

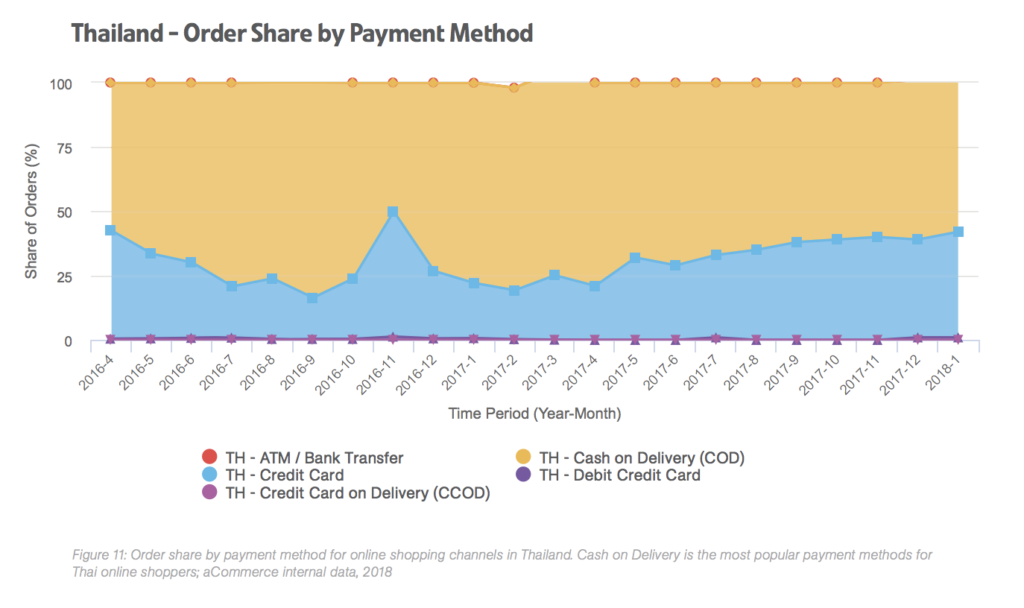

Typical payment cycles vary from 20 to 45 days and block significant capital for websites with high volume 37. According to data from eCommerce, e-commerce the enabler in the region for global brands, Cash on Delivery is still the dominant payment method preferred by customers in Thailand.

In Summary

The Thai consumer is becoming increasingly tech-savvy and knowledgeable when it comes to e-commerce. In order to succeed in the Thai market, we’ll need to remember to earn Thai shoppers’ trust.

Be transparent about pricing and deliveries, use a more personal and conversational approach with them, and offer them payment methods that they are comfortable with are good places to start.

However, this only covers how to reach them online. After closing the sale, we’ll still need to factor in how best to deliver their item from your premises to the Thai shopper’s doorstep.

Keep an eye out for our next article where we’ll share with you the potential logistics challenges when delivering in Thailand and how best to deal with them.