European e-commerce is the voice of the European digital commerce sector. With 19 national e-commerce associations, more than 75,000 companies are represented selling goods and services online to consumers in Europe.

Recently, the E-commerce Foundation has released a new report on the European e-commerce market, which has some useful insights for European dropshippers to grow further.

I: Progress: Key Figures Summarized

1. Most B2C e-commerce is concentrated in Western Europe

Western Europeans are keen on shopping online because most B2C e-commerce is concentrated in the region. The largest share of B2C e-commerce revenue is concentrated in Western Europe (66%).

Consumers in Switzerland, the United Kingdom, Denmark, and the Netherlands are often shopping online. According to statistics, 88 percent of Swiss consumers made an online purchase at least once last year, 87 percent in the UK, 86 percent in Denmark and 84 percent in the Netherlands. While Switzerland leads this list, Ukraine comes last with only 22%.

2. There are high online consumption rate in Northern Europe

Northern Europe not only enjoys a high Internet penetration rate but also has the highest spending per online shopper. Scandinavians spent 2,046 euros per person online last year, followed by Western Europe at 1,974 euros.

3. Eastern European consumers prefer shopping at physical stores

Consumers in Kosovo and Montenegro are among the least inclined to shopping online in Europe, they prefer shopping at physical stores. Consumers in Romania, Cyprus, and Bulgaria also prefer physical stores rather than online shopping, while in Poland only 2 percent prefer physical stores over online stores.

4. Polish’s enthusiasm for online shopping is second to none

In Poland, however, only 2 percent of consumers said they preferred shopping in brick-and-mortar stores. It was followed by the UK and the Netherlands, where only 10 percent of UK consumers said they would not shop online.

5. For the Portuguese e-shoppers, payment security remains an issue

Portuguese e-shoppers most concerned about payment security, with 29 percent of them suggested this was one of the reasons why they did not like online shopping, a quarter of Turkish consumers were also skeptical about online payments, while 20 percent of Hungarian felt the same way.

6. Small countries are keen on cross-border online shopping

Malta consumers like to purchase commodities from other EU countries. According to statistics, 89% of online shopping in Malta were cross-border in 2018, followed by Cyprus (83%) and Luxembourg (82%).

7. Sales volume of B2C e-commerce are growing steadily in Europe

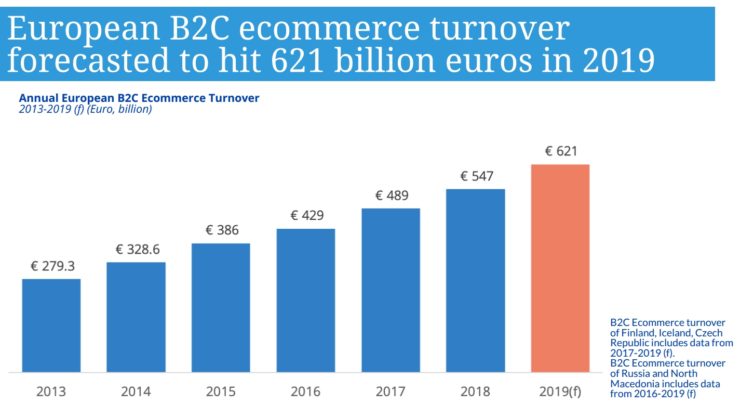

Internet penetration in Europe is at 82.5 percent. The average online shopper spending in the whole of Europe was 1,346 euros last year and is forecasted to grow to 1,464 euros by the end of this year. European B2C e-commerce transactions are expected to grow by 13.6 percent in 2019, compared with 11.8 percent in 2018 and 13.9 percent in 2017. It is expected to reach € 621 billion ($ 700 billion) in 2019, overtop € 547 billion ($ 617 billion) in 2018.

8. Amazon, eBay, and Aliexpress are the most popular platforms in Europe

Well-known platforms such as Amazon, eBay, Etsy and Aliexpress have huge influence in the European e-commerce market. It is also a way for small and medium-size enterprises (SMES) to enter the European market without building their own channels. There are also famous local platforms such as Bol.com, Zalando and Wildberries.II: Popular Online Stores in Europe

Amazon distanced itself from its top European competitors, registering 21.2% online growth in the region, where it operates e-commerce sites in six countries.

As a matter of fact, Amazon was the most-visited online marketplace in Europe in 2018. Of course, major American retailers have their influence on local e-commerce industries in Europe. Amazon is the only company on this list that’s originally from outside Europe.

Veraart Research says: “Growth will slow down in the coming years, but the company is expected to double up its turnover value in 3 to 4 years, and eventually surpass Schwarz-Gruppe as the biggest retailer in Europe by 2021.”

START & SCALE YOUR DROPSHIPPING BUSINESS FROM HERE

Austria: Amazon

Belgium: Bol.com

Denmark: Zalando

Finland: Verkkokauppa.com

France: Amazon

Germany: Amazon

Hungary: Edigital.hu

Italy: Amazon

Netherlands: Bol.com

Norway: Komplett

Poland: Allegro

Portugal: Aliexpress

Romania: eMag.ro

Russia: Wildberries.ru

Spain: Amazon

Sweden: Apotea

Switzerland: Digitech.ch

UK: New Look

III: Preferred Payment Methods in Europe

Cards account for the largest share of business-to-consumer e-commerce transactions in Europe, as research from yStats.com shows. Digital wallets are second best. In the UK, credit cards are very popular. About four in ten online transactions are paid this way, debit cards account for 35 percent of all online transactions, while PayPal is the country’s third most used online payment method. Germans like to pay with invoice, while French consumers use debit card Carte-Blue, MasterCard, American Express and PayPal. In the Benelux, iDeal (the Netherlands) and Bancontact (Belgium) are very popular.

IV: Obstacles: Turning Point

However, despite the progress resulting from good cooperation between EU policymakers and industry in building a harmonized digital single market, European businesses still face obstacles to growth, particularly beyond their national borders.

One of the biggest challenges for online merchants remains the lack of a level playing field both in the EU and globally, as players based outside Europe are able to exert significant pressure on the European market. In this context, European companies need every support from policymakers and regulators to grow in an increasingly competitive global market.

The e-commerce sector is at a turning point. If the European Union wants its businesses to play their full role in a globalized world increasingly characterized by fierce competition from non-EU businesses, it must create a harmonized market and a favorable environment in which European e-commerce businesses can thrive. The quickest solution is more investment in new technologies and digital education to enable e-commerce companies to shape Europe’s digital future.

V: Latest E-commerce News in Europe

* Etsy acquires music gear marketplace Reverb

July 23, 2019 -- Etsy, the global marketplace for handmade and vintage items, has acquired Reverb. This is a six-year-old company that enables people to buy and sell new, used, and vintage music gear. The deal is for about 246 million euros in cash.

* The Czech Republic is fastest-growing e-commerce market in Europe

July 18, 2019 -- Most growth of a European country’s e-commerce market can be expected in the Czech Republic, where it’s predicted the online retail industry will grow 16 percent between now and 2021. That’s more than in other European markets.

* Online retailers don’t need to provide a phone number

July 10, 2019 -- The European Court of Justice has decided today that online retailers don’t need to provide a phone number, as long as customers are offered other ways to contact the e-commerce company.

* Ziticity wants 45-minute deliveries in Europe

July 3, 2019 -- Ziticity, a startup from Lithuania, wants to deliver packages in Europe from pick-up points to customers within one hour. The logistics company just raised a € 315,000 seed round led by Estonia-based early-stage fund Superangel, with participation from Practica Capital, Startup Wise Guys, and angel investor Mikko Silventola.