Start your business with CJdropshipping

All-in-one dropshipping solution provider: product supplies, global logistics, free sourcing, POD, video shooting, and other dropshipping-related services.

CJ Blog

The US contains three main types of taxes imposed which are federal, state and local government taxes. Federal and state taxes are completely separate and each has its own authority to charge taxes. Each state has its own tax system that is separate from the other states. These Tax are applied on income, payroll, sales, property, dividends, imports and estates as well as different fees.

Taxes are levied on the net income of individuals and corporations by federal. Most state and some local governments, citizens and residents are applied on income worldwide and a credit is permitted for foreign taxes.

When you start a dropshipping business or other ecommerce business in US, you need to know about its business taxes and pay taxes.

Business Structures

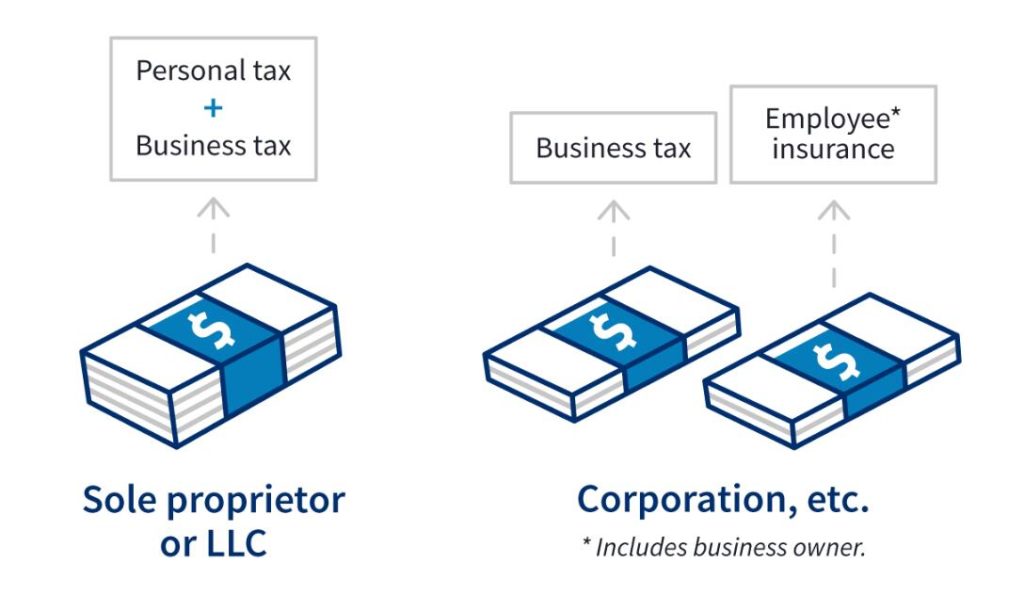

It's important to understand your federal, state, and local tax requirements as a business owner. This will help you file your taxes accurately and make payments on time. When beginning a business, you must decide what form of business entity to establish. The form of business determines which income tax return form you have to file. The most common forms of business are the sole proprietorship, partnership, corporation, and S corporation. A Limited Liability Company (LLC) is a business structure allowed by state statute. Legal and tax considerations enter into selecting a business structure.

Compare the general traits of business structures, but remember that ownership rules, liability, taxes, and filing requirements for each business structure can vary by state.

Employer Identification Number (EIN)

Most businesses require an employer identification number (EIN). Your EIN is your federal tax number. You should get one immediately after you sign up for a new business.

If you need an EIN, want to know how to get an EIN or what to do when you lose or misplace yours, please find out from the IRS.

Types of Business Taxes

All businesses, except partnerships, must file and pay taxes on any income earned or received during the year. Partnerships file an annual information return to report income, gains, losses, and other important tax information. Almost every state imposes a business or corporate income tax, though each state and locality has its own tax laws.

If you have employees, there are federal tax requirements for what you must pay and the forms you have to file. These employment taxes include Social Security and Medicare taxes, federal income tax withholding, and federal unemployment (FUTA) tax. In all states, businesses must pay state workers'compensation insurance and unemployment insurance taxes.

The federal government taxes businesses that manufacture or sell certain products. You may also have to pay this tax in other situations, including if your business uses various types of equipment, facilities, or other products.

Property taxes are typically collected by your state or local government. Your state establishes the guidelines under which local government can impose property taxes. Each of the 50 states has its own criteria for what property is taxable.

Some states allow local communities to tax real property. This includes land and items that are permanently attached to the land. Real property includes homes, factories, wharves, and condominiums.

States can also permit local governments to tax personal property. This consists of property that is movable, such as boats, cars, jewelry, airplanes, computer, equipment, tools, and furniture.

The amount of tax to be paid is figured on the total value of the property or on a certain percentage of the value.

States may impose a tax on the sale of goods and services. Rates may vary by county. Typically you pay sales tax when you purchase goods or services.

Exclusions in sales tax often include food, clothing, medicine, newspapers, and utilities. In addition, certain groups are often exempt from paying sales tax. Charitable, religious, and educational groups are often excused under certain conditions.

Many states also have a use tax. Similar to a sales tax, a use tax is imposed for the storage, use, or purchase of personal property that is not covered by sales tax. Typically this applies to lease and rental transactions or to major items purchased outside of the state, such as automobiles.

Estimated tax is the method used to pay taxes on income that is not subject to withholding. This includes income from self-employment, interest, and dividends. You may also have to pay estimated tax if the amount of income tax being withheld from your salary, pension, or other income is not enough.

Individuals who conduct their own business typically have to make estimated tax payments. You may be charged a penalty if you do not pay enough through withholding or estimated tax payments.

The year is divided into four periods to pay estimated tax. Each period has a specific payment deadline.

Self-employment tax (SE tax) is a social security and Medicare tax primarily for individuals who work for themselves. Your payments of SE tax contribute to your coverage under the social security system. Social security coverage provides you with retirement benefits, disability benefits, survivor benefits, and hospital insurance (Medicare) benefits.

Generally, you must pay SE tax and file Schedule SE (Form 1040) if either of the following applies.

In conclusion, each category of business tax might have special rules, qualifications, or IRS forms you need to file. You can check with the IRS to see which business taxes apply to you.

If your business has employees, you might be required to withhold taxes from their paychecks. Federal employment taxes include income, Social Security and Medicare, unemployment, and self-employment taxes. You can check with the IRS to see which taxes you need to withhold.

Tax Incentives and Deductions

Energy efficient appliances and energy-saving improvements can get you or your business tax credits, rebates, and savings during sales tax holidays. Tax credits reduce the amount of tax you owe, and rebates give you cash back on your purchase.

And individuals and businesses recovering from a major disaster or emergency can get tax relief. Businesses can also receive a tax deduction for qualifying charitable donations.

Tax Reform in 2018

The new law made the following big changes about federal income tax:

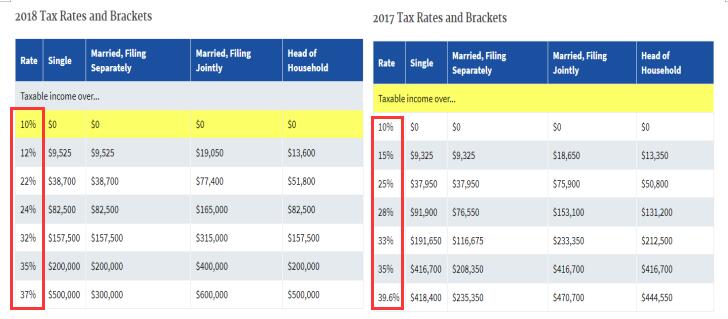

You can see how much it's changed under tax reform in the image below:

Pay Tax

Your business is legally required to pay taxes and keep accounting records on a consistent yearly schedule called a tax year.

Most businesses choose their tax year to be the same as the calendar year. You select your tax year the first time you file for taxes, but can change it later with permission from the IRS.

Your business might need to pay state and local taxes. Tax laws vary by location and business structure, so you’ll need to check with state and local governments to know your business’ tax obligations.

The two most common types of state and local tax requirements for small business are income taxes and employment taxes.

You can find your state tax obligations through this link:

https://www.sba.gov/business-guide/manage-your-business/pay-taxes

Your business structure determines what federal taxes you must pay and how you pay them. Some of the taxes require payment throughout the year, so it’s important to know your tax obligations before the end of your tax year. There are five general types of business taxes including income tax, self-employment tax, estimated tax, employer tax, excise tax, that have been introduced above.

You can check with the IRS to see which business taxes apply to you and taxes you need to withhold:

Chat

Share