As a result of the Brexit Transition Period that ends on December 31st, 2020, the new UK VAT laws will come into force from January 1st, 2021.

In this article, you will know about:

1. The details of VAT import regulations for the UK and EU from 2021.

2. What kinds of sellers are involved?

3. How to set VAT in the Shopify and eBay stores?

1. The details of VAT import regulations for the UK from 2021.

The VAT in the EU known as Value Added Tax that is collected by VAT-registered traders on their sales within the EU territory, and passed on to the national tax authorities via VAT return filings.

Under the new UK VAT laws from January 1th, 2021, VAT needs to be collected and remitted on orders up to a value of £135 imported into the UK and sold to consumers. There will no longer be a VAT exemption for small consignments up to £15.

If the value exceeds £135, it will still be remitted in former ways and won't be affected by the new VAT laws.

If you are selling products via third-party e-commerce platforms such as Amazon etc, the platform will collect the VAT.

If you are selling products on your own online store, you need to register and provide the VAT number. The VAT needs to be remitted by the seller directly to the HMRC.

If you haven't registered for the VAT, you can apply for one online.

The standard rate of VAT is 20%. Please speak with a tax professional if you have any questions about your tax obligations.

2. What kinds of sellers are involved.

· The UK seller whose business is located in the United Kingdom and sells to customers in EU member countries.

· The EU seller whose business is located in a European Union member country other than the United Kingdom and sells to customers in the UK.

· The non-UK seller who sells to customers in the UK.

3. How to set VAT in the Shopify and eBay stores?

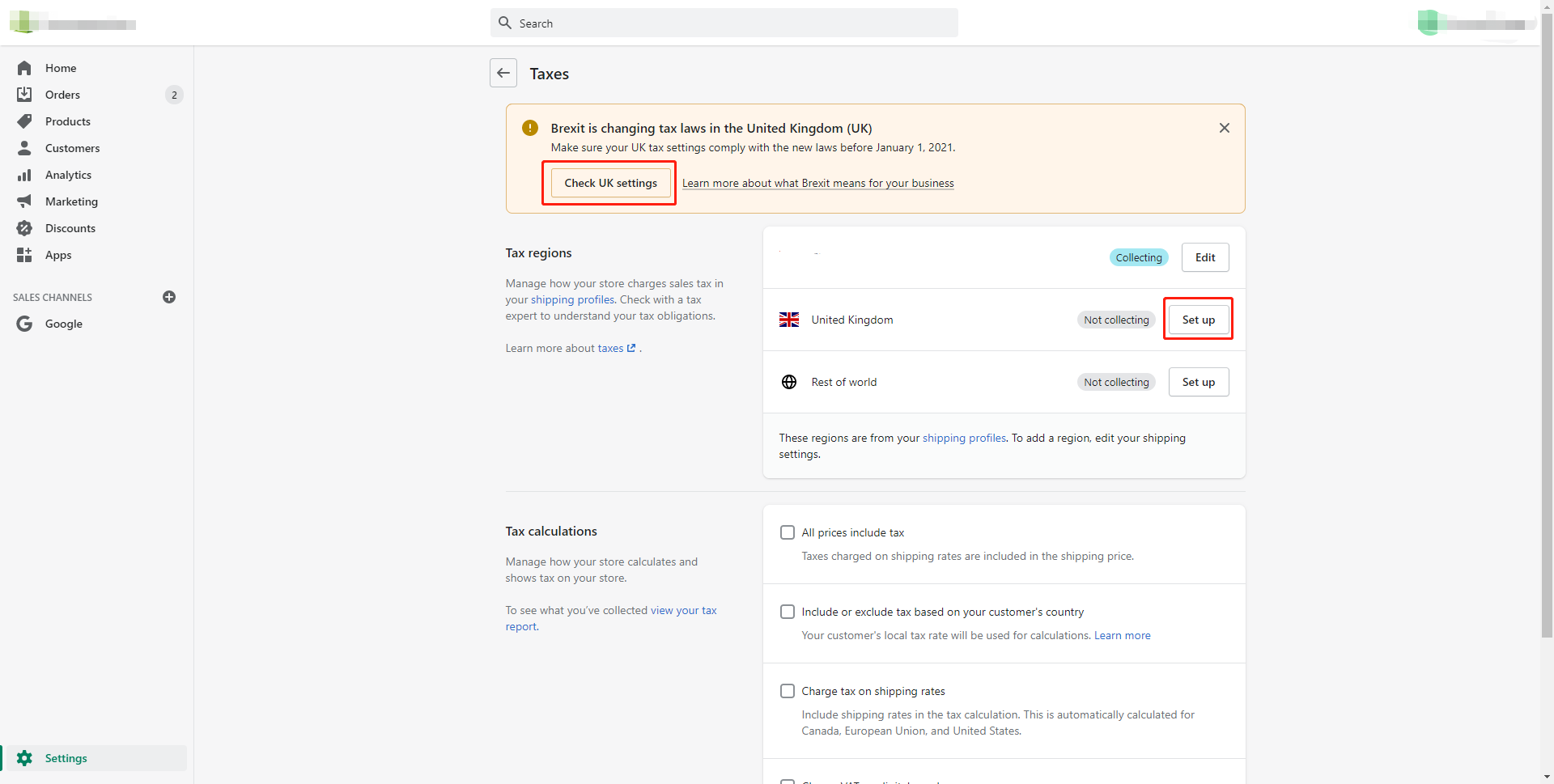

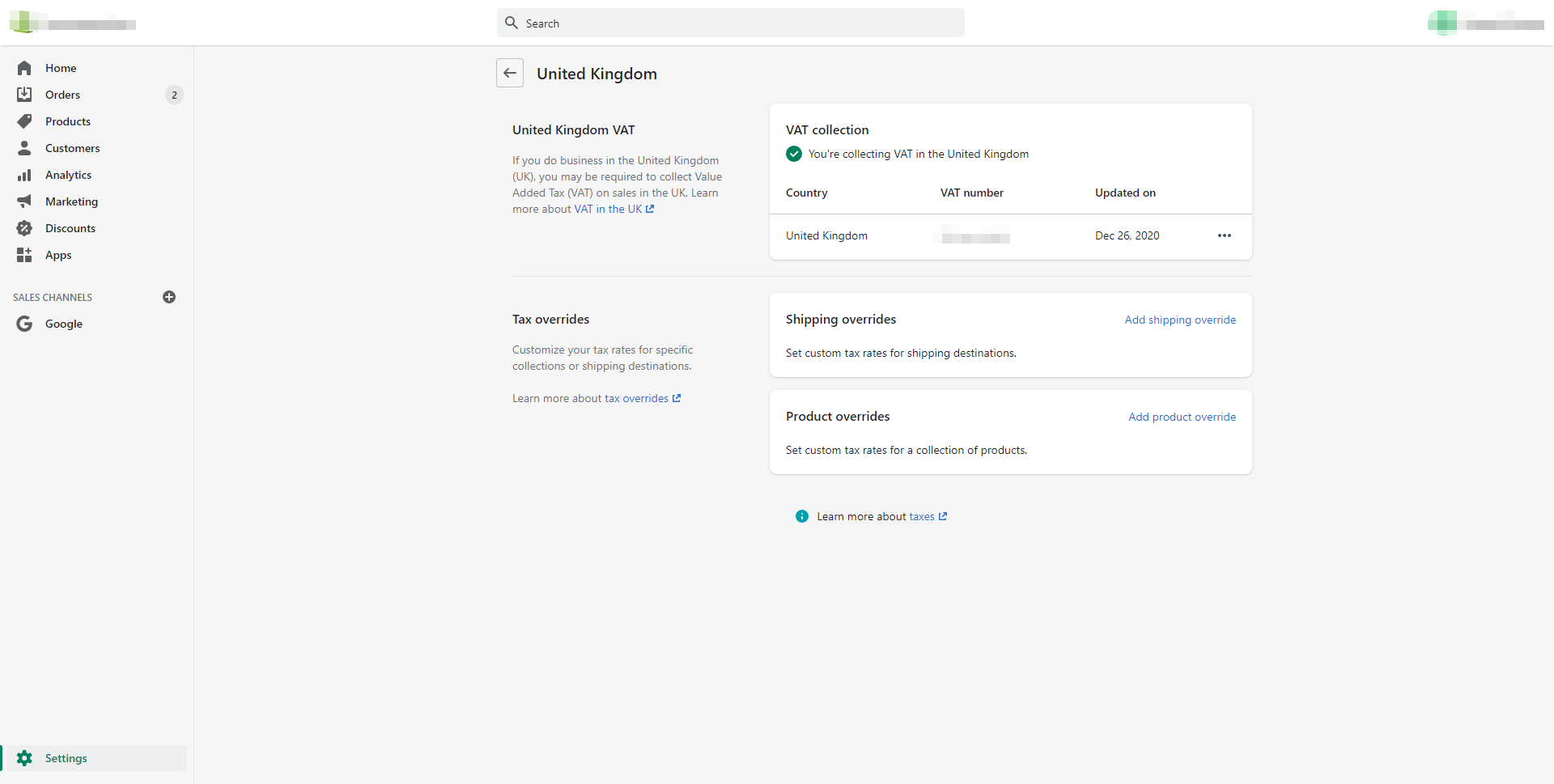

Go to Shopify Settings > Taxes. In the VAT collection section, click Collect VAT.

In the VAT number, enter your VAT number. If you have applied for a VAT number but don't yet have one, then leave this field blank. You can update it when you receive your number.

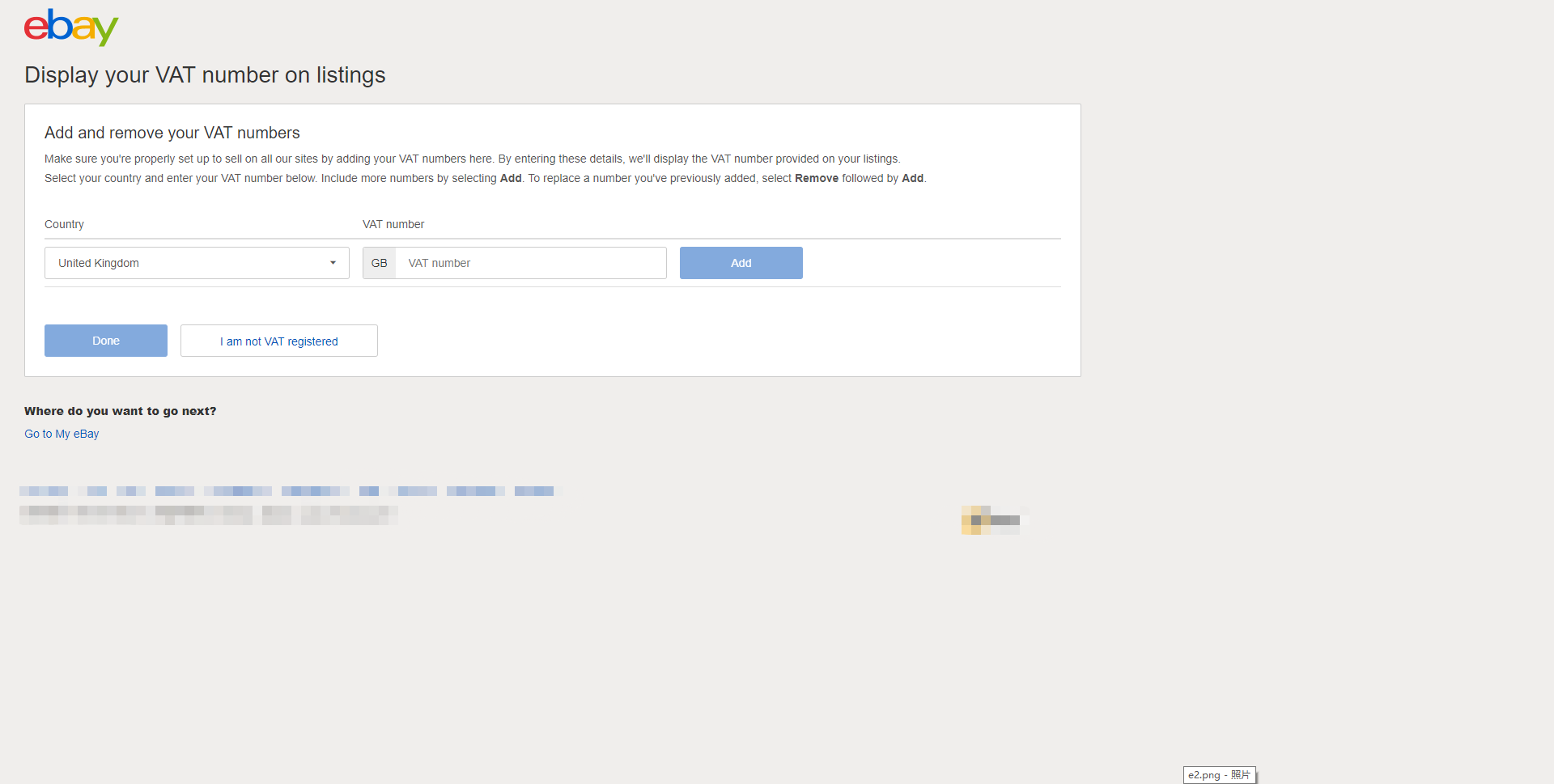

b. Setting VAT on eBay.

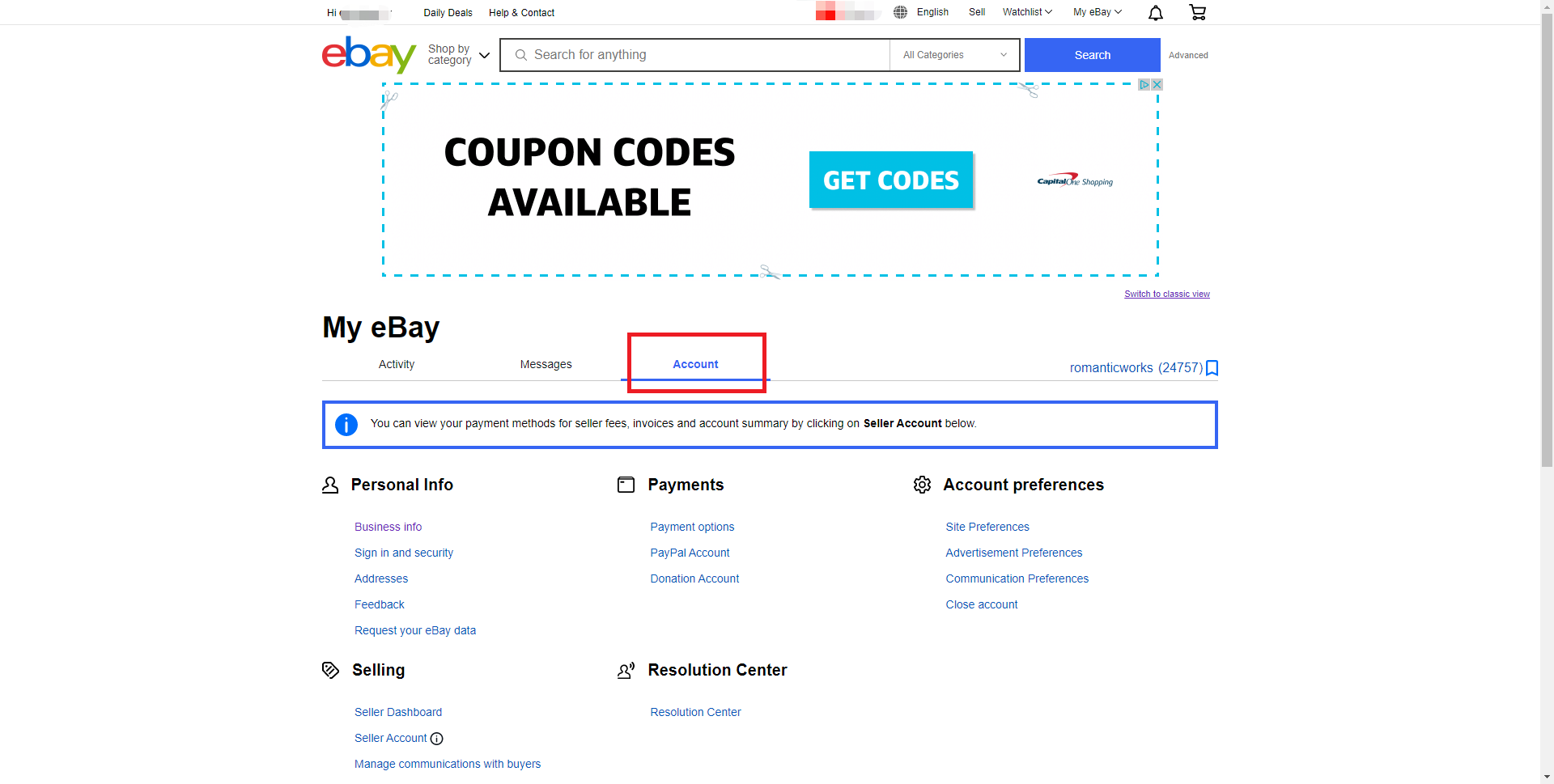

My eBay > Account > Selling Preferences.

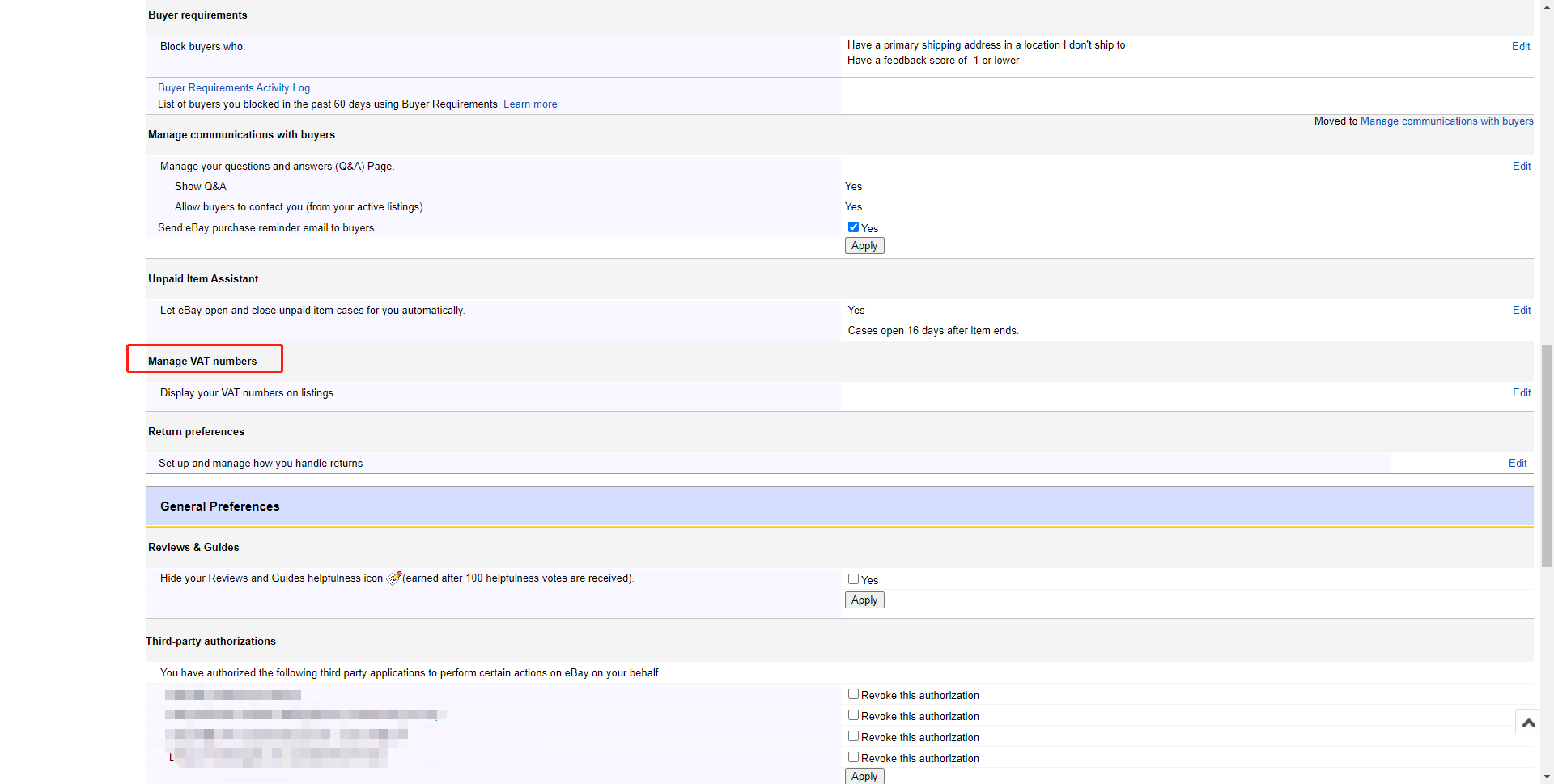

Manage VAT numbers > Edit.

Add the information.

With any uncertainties, please contact our online agent anytime.

.jpg)